According to former Moody’s VP Chris Mahoney, certain religious groups are simply incapable of understanding monetary policy:

Why is the Right so in love with hard money, low inflation, and high unemployment? Here is my answer: because they do not believe that there is such a thing as a free lunch. You could spread out a smorgasbord of caviar, salmon, lobster and Dom Perignon, and they would turn their heads and eat a cheese sandwich. Reflation is easy and thus sinful. It’s that Protestant thing. The only people who understand monetary policy are Jews and Catholics.

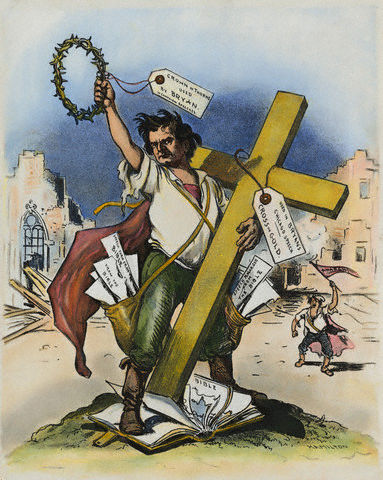

As a Catholic, I certainly find this theory flattering. But I wouldn’t carry the religious angle too far. William JenningsBryan, for example, somehow managed to be both a devoted Protestant and a firm advocate of expansionary monetary policy, while the two biggest defenders of the Austrian School approach to monetary policy (Mises and Rothbard) were both Jewish.

Still, I do think Mahoney has put his finger on one reason why many conservatives and libertarians view monetary expansion with such a jaundiced eye. If there is one economic lesson the Right has internalized, it is Heinlein’s aphorism that There Ain’t No Such Thing As AFree Lunch. And attempts to improve the economy by what is often derisively described as “printing money” can at first blush seem like, if not a free lunch, then at least as free lunch money.

Appearances, though, can be deceiving. Heinlein excepted, there is probably no figure more responsible for popularizing TANSTAAFL than Milton Friedman. And Milton Friedman, firm libertarian that he was, also urgedJapan to engage in quantitative easing, condemned the Austrian School, and arguedthat a lack of monetary action was responsible for the Great Depression.

So what gives? On one level, the idea that you can make a society richer by printing out green pieces of paper (or, even worse, by changing a few digits on a computer screen) sounds absurd. But then, the idea that a giant metal tube could float through the air sounds pretty absurd too. Technology is like that, and money (including fiat money) is a technology just as much as air travel.

I don’t think opponents of “money printing” would deny that the existence of money can make a society richer. Barter is inconvenient, after all, and societies that don’t have a commonly accepted medium of exchange tend to be a lot poorer, for obvious reasons, than those that do.

Likewise, just as the use of money can make society wealthier, a well-functioning monetary system can result in a society that is wealthier than if the monetary system is somehow out of whack. On some level opponents of QE get this too. Hence the references to Zimbabwe. But where they often seem to fall short is in realizing that just as a monetary system can get out of whack if there is too much money, so can it be suboptimal if there isn’t enough money.

Suppose, for example, that America was hit with a computer virus that substantially lowered the balance of checking and savings accounts throughout the U.S. If nothing was done to counteract this, businesses throughout the country would find themselves unable to meet payroll, and would be forced to lay off workers or declare bankruptcy. Individuals would be unable to make their mortgage payments, and even those not directly affected would be harmed as the effects of this deflationary virus rippled through the economy.

Of course, eventually prices and wages would adjust downward to reflect the lower quantity of money. But this would be a long and painful process. It would be much better, if possible, to simply counter-act the effects of the virus, by “printing money” to cover the losses. Far from being a “free lunch,” things like QEWhatever are simply an attempt to avoid the disinflationary impact of the financial crisis and its aftermath.

Tidak ada komentar:

Posting Komentar