Karl Smith Adam Ozimek has a blog post up about

whether economics is a science. This is a questions I've thought about a lot. It's a difficult one, for (at least) two big reasons:

1. There are a whole bunch of branches and sub-fields of economics.

2. There is a big difference between how economics is practiced and how it could be practiced.

For an example of the first problem, consider

Prospect Theory. This Nobel Prize-winning theory is a kind of cognitive psychology - Daniel Kahneman put people in a lab and tried to figure out how they calculate probabilities and take risks. There are a lot of economists doing stuff like this - another example is Vernon Smith, who also won a Nobel.

But then again, consider macroeconomics. You can't put a national economy in a lab, so falsification has to wait for history to come prove your theories wrong. In the meantime, people make lots of assertions that just can't be backed up. This is how we got

Real Business Cycle Theory (a favorite whipping boy of mine).

So some economists are doing science, and some aren't. Actually, this is generally true of most of the fields we call "sciences". Biology, for example, contains plenty of science, but it is also home to "

Evolutionary Psychology," which consists mainly of non-falsifiable just-so stories. Even physics, which is usually held up as a paragon of scientific rigor, generates its share of

seemingly non-falsifiable theories.

For an example of the second problem, take the recent progress that has been made in game theory. Game theory started out as just math - you assume players follow certain rules and face certain choices, and then you derive what they would (or might) do. For a long time that's all it was. You had (and still have) people trying to think up games whose results seemed to mirror real-world phenomena, but this was not science, since there were many games and many equilibrium concepts that could yield the same result (and nobody really tried to test which was really in effect). But more recently, experimental economists have started putting

people in labs and finding out how people really play games. This is science.

So a non-scientific branch of economics may become scientific in the future.

Now to me, here's the more important question: Should economics be a science?

To answer this question, observe that there are two reasons why some economists do science and some don't. Sometimes economists don't do science because they don't have the tools to do it. Others don't do science because they don't think they should have to. In general, I think the first is a good reason not to do science, and the second is a bad reason. Let me explain why.

Many times, we find ourselves able to observe the world, but not in a controlled way. For example, take history; we can see what happened, but we don't know why, since we can't put history in a lab. In the "social sciences," you have lots of people doing empirical work by observing statistical correlations - but, unless they can find natural experiments, they can't infer causation. Are all of these useless endeavors? NO! Observation without falsification isn't science, but it is still useful. Naturalistic observation narrows down the set of possible explanations for phenomena that are too big and complex to test - and there will always be some phenomena that are too big and complex to test.

So I think that much non-scientific empirical work has value.

However, there are times when economists have the tools to do science, but simply fail to make use of those tools. This is generally due to the academic culture of the field. Behavioral economics experiments, for example, encountered (and still sometimes encounter) huge resistance from theorists who thought that their speculations about human behavior were more powerful than actual empirical tests. As another example, take Ed Prescott's assertion of "

theory ahead of measurement" - the idea that observations should be ignored when they contradict intuition.

In cases like these, it seems to me that economics suffers from cultural holdover from the time when economics was basically philosophy. For centuries, even as chemists and physicists and biologists were constructing labs, "economists" were still basically writing literary tomes full of speculation and hand-waving. In the mid-20th century, this hand-waving approach was (mostly) replaced with a combination of rigorously defined mathematical explication and empirical statistical analysis. But neither math nor statistics (nor both together) is sufficient to make a discipline scientific; for that, you need experiments.

Although, as I said, I believe that science is not the only valuable way to explain the world, it seems to me that, when it can be done, it is the best way. Falsifiable theories, when they've withstood our best attempts at falsification, are just better at predicting the future than any other kinds of theories*. Thus, when economists can do science, we should do science.

And when we can't do science, I think we could stand to be a bit more humble and circumspect when advancing our theories and making our policy prescriptions. Take macro, for example. The debate between Keynesians, monetarists, and neoclassicals won't be resolved any time soon, because we can't do experiments to find a falsifiable theory of business cycles (and because history has weighed in against every theory we've ever constructed). The general public has caught on to this fact, and has come to expect less of its macroeconomists. But macroeconomists seem not to expect less of themselves, and still tend to radiate an aura of intellectual confidence that seems a bit unjustified.

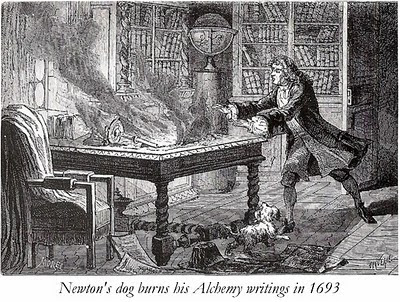

And finally, to critics of the economics field in general, just remember: Economics is a very young discipline. As a formal field of study, it's really less than a century old; as a science, less than half of that. Remember that chemistry, which is now probably the hardest of the hard sciences, was for long centuries a mix of alchemy, superstition, and real science. Ptolemaic astronomy persisted for centuries before we had the telescopes to prove that Copernicus had a better theory. As humans develop the tools to more accurately observe big, complex systems and groups, economics will become progressively more scientific. Maybe with a lag; after all, it takes time to bury accumulated centuries of philosophy and religious canon under a mountain of experimental data. But it will happen.Updates: 1. Mike the Mad Biologist has a rant about econ vs. biology. It is a pretty good rant, though a bit tangential to what I've been discussing here. The key takeaway line is this: [T]he key difference [between biology and economics] is that biology has accepted modes of confronting theories and, importantly, discarding them.

Exactly. Econ doesn't always have the means to discard bullshit theories. But sometimes we do have the means and we choose not to use them. That is bad. Mike also links to Barry Eichengreen saying:The late twentieth century was the heyday of deductive economics. Talented and facile theorists [could] build models with virtually any implication, which meant that policy makers could pick and choose at their convenience. Theory turned out to be too malleable, in other words, to provide reliable guidance for policy.

In contrast, the twenty-first century will be the age of inductive economics, when empiricists hold sway and advice is grounded in concrete observation of markets and their inhabitants. Work in economics, including the abstract model building in which theorists engage, will be guided more powerfully by this real-world observation. It is about time.

What Barry said.

2. Peter Dorman has some musings on the meaning and value of science that echo my own, and he concludes with an excellent prescription for the field of econ:So what would a scientific economics look like? I have mostly answered this already: it would look like other sciences whose objects of study are complex, heterogeneous and context-dependent [like geology and hydrology]. It would study mechanisms primarily and end states only for heuristic purposes. It would be predominantly empirical, where this encompasses both statistical work and direct observations on economic behavior (which may also entail statistical analysis)...Experimentation, in the lab and in the field, would become more common, but even more important, primary data collection of all sorts would be accorded a very high value, as is the case in all true sciences. Its macro models would come to look like macro models in hydrology or biogeochemistry: simultaneous differential equations representing mechanisms rather than static end states embodying (a single) equilibrium. Economists would increasingly find it useful to collaborate with researchers from other fields, as their methodological eccentricities are abandoned. Finally, there would be a much clearer distinction between the criteria governing scientific and policy work, insulating the former from some of the influence exerted by powerful economic interests and freeing the latter to adopt an ecumenical and risk-taking approach to tackling the world’s problems.

Sounds about right to me!

I recently posted an article about data loss and the risk of losing hard to restore information from your computer. In the article it was mentioned that we would share a few more specific examples of ways to protect your computer data from total loss. One example of securing your data and backing it up is a service called Dropbox. Dropbox is a cloud like program. This means that all your computer data is safely secured on different Dropbox servers throughout the country as well as on your personal computer. If your personal computer ever suffered a hard drive crash, was stolen or was damaged in a fire all you would need to do is replace your computer and download all your data from the Dropbox servers. You can do 2GB of storage for free or pay $9.99 a month for 50GB of storage. If 50GB is still not enough you can pay $19.99 a month for 100GB of storage.

I recently posted an article about data loss and the risk of losing hard to restore information from your computer. In the article it was mentioned that we would share a few more specific examples of ways to protect your computer data from total loss. One example of securing your data and backing it up is a service called Dropbox. Dropbox is a cloud like program. This means that all your computer data is safely secured on different Dropbox servers throughout the country as well as on your personal computer. If your personal computer ever suffered a hard drive crash, was stolen or was damaged in a fire all you would need to do is replace your computer and download all your data from the Dropbox servers. You can do 2GB of storage for free or pay $9.99 a month for 50GB of storage. If 50GB is still not enough you can pay $19.99 a month for 100GB of storage.