How should macroeconomists think about Japan's stagnation? By far the most popular and dominant view of the way macroeconomies work is the monetarist view popularized by Milton Friedman and formalized in DSGE models by Mike Woodford, Greg Mankiw, Guillermo Calvo, Jordi Gali, and other "New Keynesians". This view is so commonplace that many have internalized it.

A quick review for the uninitiated: In this view, the economy's performance consists of short-term "fluctuations" around a long-term "trend". The fluctuations are caused by "demand-side" factors like monetary policy and financial disturbances, while the "trend" is caused by "supply-side" factors like technology, gains from trade, taxes, and institutions.

In the New Keynesian models, which now mostly dominate the core of business cycle research, the demand-side effects come from sticky prices, including sticky wages. (This is not the only way you can get demand-side effects; inattention can get very similar results.) Once the sticky prices have had time to adjust, the economy returns to trend. In most New Keynesian models, the parameter that represents the time that it takes for prices to adjust is the "Calvo parameter". The smaller the Calvo parameter, the longer it takes demand shortfalls to go away on their own. The "short run" is the time during which prices have trouble adjusting; the "long run" is when they've had time to adjust.

In a New Keynesian model, when there is a demand shortfall, unemployment is the result. The central bank can print money in order to combat the shortfall, which raises inflation and lowers unemployment. But if the central bank does nothing, prices will eventually adjust, and unemployment will go away. This New Keynesian model corresponds nicely to the simple AD-AS model that people learn in Econ 102.

Is this kind of model the right way to think about Japan?

At first glance, it would seem that it is. After all, many of the people supporting Abenomics think that expansionary monetary policy will boost the real economy. That naturally suggests a mainstream, New Keynesian model or simple AD-AS model. Here, just for an example, is Nick Rowe thinking about Japan in the context of that sort of model.

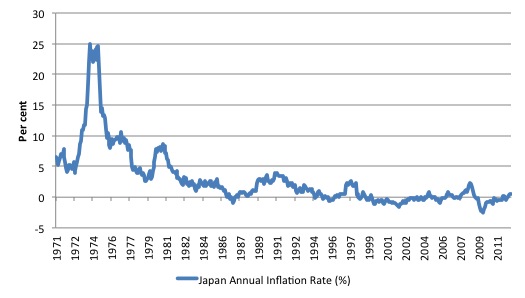

But in order for monetary easing (the "first arrow" of Abenomics) to be the optimal policy in a New Keynesian world, the problem has to be an aggregate demand shortfall. And there are two reasons to think that this may not be what is happening to Japan. First of all, an aggregate demand shock should cause deflation (or disinflation) for only a short time. But Japan's deflation/disinflation has been going on for twenty years straight:

Presumably, prices and wages are able to adjust in 20 years' time. So an aggregate demand shock, even one as big as the bursting of the Japanese bubble in 1990, should not last nearly this long.

And there is the question of whether Japanese wages and prices are even particularly sticky in the first place. Here are Japanese wages:

Wage growth is sharply negative in some years, indicating that Japanese wages may not be so sticky. See also here. (Compare this to the U.S., where wages failed to fall much even during the big recent recession.)

So how can we be looking at a sticky-price story for Japan's stagnation? Well, we could be looking at a very long series of negative demand shocks. Japan could have just kept getting hit with shock after shock, giving the appearance of a long steady decline. But what were those shocks? If they were global in nature (such as the Asian financial crisis, the tech bubble, etc.), there's the question of why other countries around the world haven't mirrored Japan's deflationary experience. And a long string of negative domestic demand shocks is not in evidence.

It seems to me that the standard New Keynesian sticky-price story just cannot explain Japan. The "short run" for Japan is over and done. We are not looking at a "short-run" fluctuation caused by sticky prices.

This has implications for policy. It means that we can't expect the "first arrow" of Abenomics - quantitative easing - to boost the real economy through the kind of channel described by a New Keynesian or AD-AS model. It might do so through some other channel, but how exactly that will work is not clear.

What about the supply-side? Is Japan living in an RBC world? Well, it's true that Japan's total factor productivity has flatlined since the early 90s. Here's a not-quite-up-to-date graph from Hoshi & Kashyap (2011), but recent years have not looked any better:

This could suggest an RBC-style story of institutions and regulation choking off productivity growth (which is, in fact, the story Hoshi and Kashyap tell).

Also, Japan's labor hours per employed person have been in secular decline for about the same amount of time:

This suggests that Japan's stagnation could be partly caused by people deciding to work less - not necessarily a bad thing in a nation infamous for overwork. Instead of a "great vacation", call it a "great coffee break".

But I don't think Japan is living in an RBC world either. Because in an RBC world, keeping interest rates at zero for decades, and printing a bunch of money (as the Bank of Japan did in the mid-2000s), should cause inflation (without helping growth). Instead, we see persistent deflation. So an RBC model of the common type can't be describing Japan's world either.

So what sort of model is Japan living in? I'm not sure I know any model that describes Japan; maybe we don't have one. But my guess is that it's a world in which "Aggregate Demand" and "Aggregate Supply" are not as distinct entities as they are in Econ 102. In an AD-AS framework, either the AD curve or one of the AS curves shifts on its own. But in Japan, it may be that what look like supply shocks (falling productivity) and what look like demand shocks (deflation) may actually be due to the same cause.

And whatever world Japan is living in may have multiple equilibria. It may be that Japan is trapped in a "bad equilibrium", and it will require a "big push" to kick it back to the "good equilibrium". In fact, that seems to me to be the implicit premise of Abenomics.

In any case, we shouldn't be thinking about Japan solely in terms of our standard textbook models. The real world appears to be much weirder than those toy environments.

Update: Paul Krugman says zombies have eaten my brain:

Yes, in a standard AS-AD or NK model, high unemployment leads to falling wages and prices, and this eventually restores full employment...

[But]the only reason deflation “works” in the standard model is that it increases the real money supply, which leads to lower interest rates; in effect, it acts like an expansionary monetary policy...

But Japan has been in a liquidity trap during the whole period Smith looks at. Monetary expansion is ineffective unless it can raise expectations of future inflation. Deflation is definitely not going to help. In fact, by raising the real burden of debt, it makes things worse...

A corollary is that while sticky wages are a real phenomenon...They are not, repeat NOT the reason either Japan or we have failed to recover.But this doesn't really contradict what I was saying in this post. Just like Krugman says, a standard AD-AS or New Keynesian model would imply that Japan's deflation would have gone away on its own long before now. That was my point. So I'm not sure zombies have eaten my brain. (Then again, with no brain left, how is one to know?)

Now let's talk about liquidity-trap models. The story that Krugman tells - debt-deflation keeping price adjustments from clearing markets - is intuitively plausible (to me, anyway). I freely admit that I have not worked through a liquidity trap model in sufficient detail to know all the ins and outs of how one works. In one of these models - for example, Eggertson & Krugman (2011) - are there multiple equilibria? Is it possible for a negative shock to push a country into a bad liquidity-trap equilibrium, out of which it cannot escape unless it receives a big "kick" (from policy or from a positive exogenous shock)?

If so, then liquidity-trap models of the Krugman type are a candidate for the "multiple equilibria" story that I said I think is necessary in order to explain Japan's stagnation as a demand-side phenomenon. If liquidity-trap models are the replacement we need for textbook AD-AS and New Keynesian models, then economists and the general public need to thoroughly revise the intuition that we use to think about recessions.

But if liquidity-trap models do not contain multiple stable equilibria, then the length of Japan's deflation needs a different explanation. Frighteningly, the answer may depend on whether the model is linearized or not. (Note: It would also be easier to answer if I could find a set of impulse response graphs for a liquidity-trap model. But I can't find one...)

(Note that though I haven't worked through the details of an Eggertsson-Krugman type model, I do know other modified New Keynesian models that include a "bad equilibrium". One of these is a model by Miles Kimball and Bob Barsky, which they have not yet published online as a working paper. They should get around to doing that!)

Update 2: Ikeda Nobuo, Japan's most widely read econ blogger, responds (in Japanese), attributing Japan's stagnation to a long-term sectoral shift. Shades of Joe Stiglitz.

Update 3: Steve Williamson chimes in, chiding me for equating AD-AS with a standard New Keynesian model, and discussing liquidity traps with some simple graphs.

Tidak ada komentar:

Posting Komentar